On April 7, one bitcoin was worth approximately $74,500—a price about 32% below the all-time high earlier this year. Since then, we haven't seen a lower price. This observation was accompanied for weeks by a burning question: “Is this bull market correction now over?”

With bitcoin now trading around $100,000, I dare—knocking on wood—to answer that question with a “yes.” But in fact, a simple counter-question seems more appropriate: “What bull market correction?”

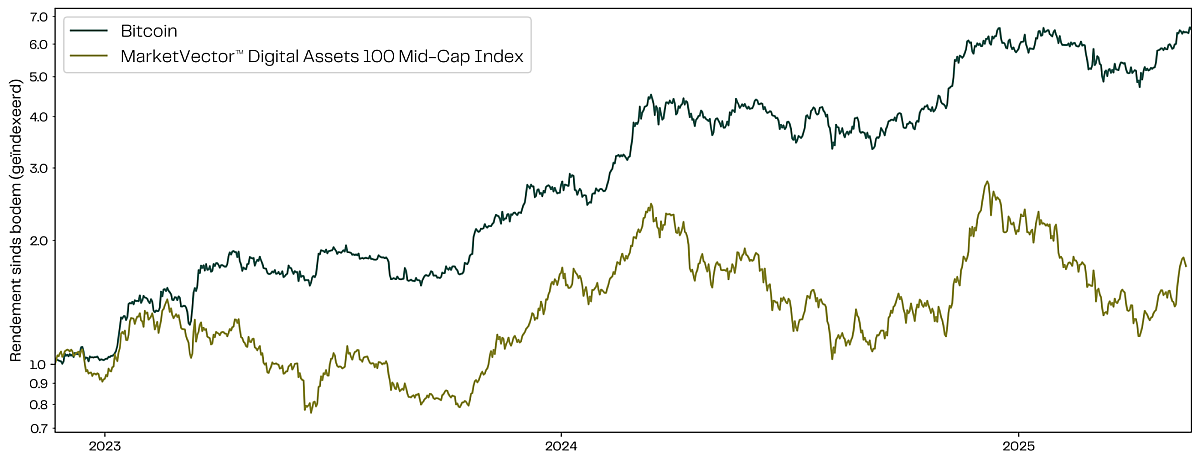

Figure 1: Bitcoin and altcoins since November 22, 2022—the date of the lowest total crypto market capitalization in the past four years.

What particularly disappointed was the altcoin space. To properly assess this, we look at the MarketVector Digital Assets 100 Mid-Cap Index. This index tracks mid-cap altcoins and offers a clear picture of the market, separate from bitcoin, ether, and the largest altcoins.

As seen in Figure 1, this index moved mostly sideways during the same period and is currently “not even” up 100%. Bond investors would be thrilled with these figures, but in the crypto market, we’d rather call it “upward volatility.” In any case, it’s not a true bull market.

A break from the past

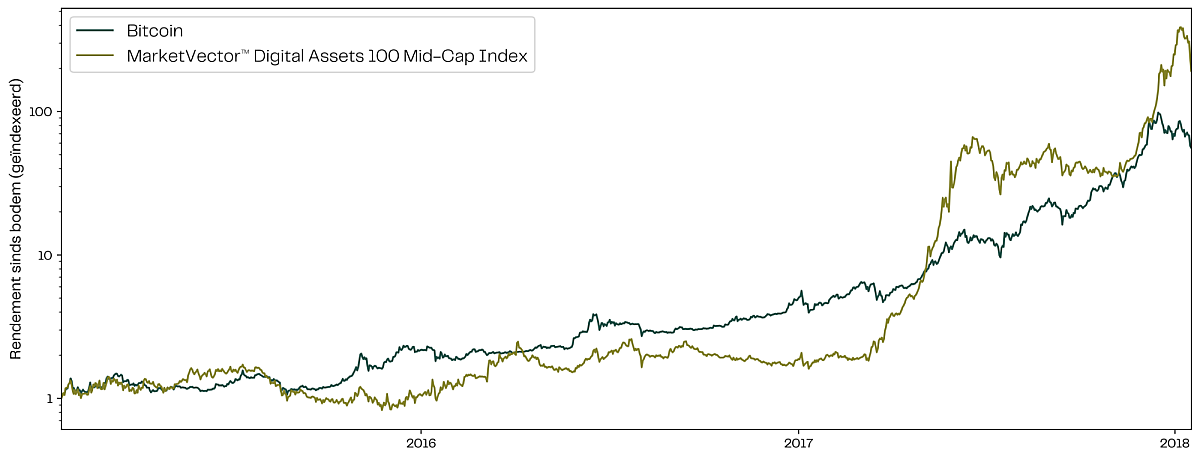

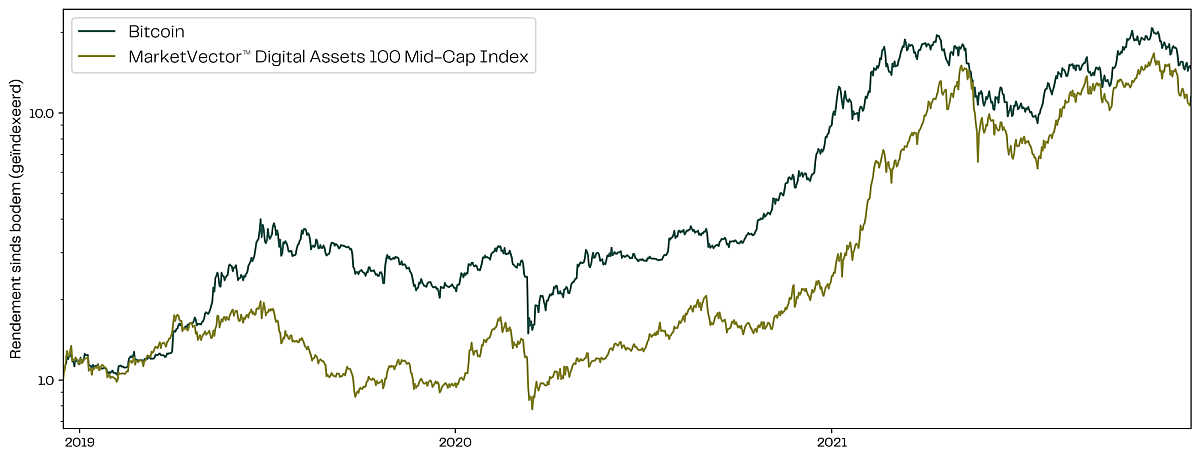

The significant discrepancy between bitcoin and altcoins is, at the very least, unexpected. In this young sector, we don’t have an inexhaustible supply of historical data, but the previous two bull markets were clearly characterized by a specific dynamic: bitcoin leads, and altcoins aggressively follow.

Figure 2: Bitcoin and altcoins since January 17, 2015, and December 16, 2018—the dates of the lowest total crypto market capitalization in the past 8 and 12 years, respectively.

So where did this sudden turn come from? And are we dealing with a structural change, or just a temporary obstacle in an otherwise thriving altcoin market?

Is bitcoin running away with it?

Some would argue that bitcoin has always been fundamentally superior to altcoins, and that the world is finally realizing that the rest of the crypto market has little to offer compared to bitcoin’s immense network and recognition. That may be possible, but in my view unlikely for several reasons:

- Bitcoin is the asset that put blockchain technology on the map, but altcoins stand on bitcoin’s shoulders. They apply the technology in many areas—more efficiently, faster, and therefore better than bitcoin.

- The argument that bitcoin is more decentralized than other blockchains is valid, but for many investors, it’s only as relevant as other characteristics like speed, activity, or simply popularity.

- The crypto market is filled with technological developments and attracts many participants who anticipate them. Bitcoin is the market leader, but if the ecosystem doesn’t continue to innovate, it will inevitably fall short for that group of investors.

If crypto were seen as a (digital) commodity market rather than a technological market, the arguments above would largely lose their weight. However, based on current adoption, price movements, and market volatility, we can conclude that there’s still a long way to go before crypto is widely seen in that way.

Patience was a virtue...

I believe institutional interest is a more plausible explanation for the current situation. While everyone and their mother claimed in 2021 that institutions were entering the crypto market, this observation only became tangible in 2024. Today, several publicly traded companies hold bitcoin on their balance sheets, popular spot bitcoin ETFs have been launched, and major asset managers actively offer bitcoin.

These developments were long overdue because these financial giants simply act slower than the average retail investor. And for that very reason, it’s not surprising if the shift in interest from bitcoin to altcoins also takes longer.

...And patience still is a virtue

The participation of larger players doesn’t necessarily mean the pattern has disappeared. In my view, it just means the pattern has changed—resulting in more stable and less abrupt price increases for bitcoin. Altcoins will still follow—perhaps less aggressively, but most importantly: later.

This article was written in a personal capacity by Tim Stolte and does not constitute financial or investment advice.

Our website uses cookies

We use cookies to personalize content and advertisements, to offer social media features and to analyze our website’s traffic. We’ll also share information about your usage with our partners for social media, advertising and analysis. These partners can combine this data with data you’ve already provided to them, or that they’ve collected based on your use of their services.