BitVM allows all computer programmes to run on bitcoin, say developers

13 October 2023

It was an eventful week. For instance, the court ruled in a case between the Dutch crypto sector and DNB. Sam Bankman-Fried's ex-girlfriend was on the witness stand. And a new proposal appeared that bitcoiners are excited about. All this, and more, in this Weekly!

Cryptomarket

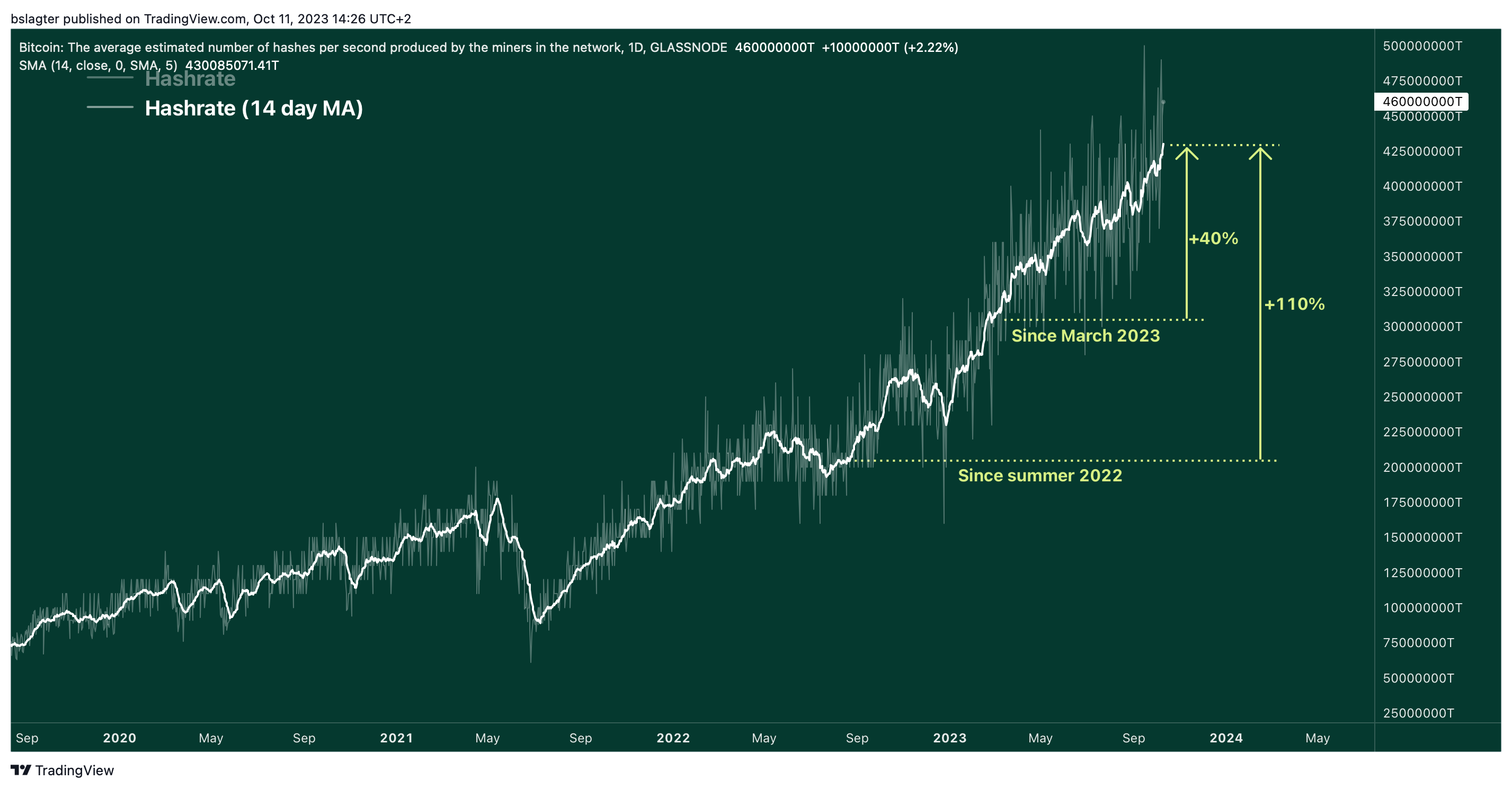

For the past 7 months, bitcoin's price has been around $27,000, sometimes slightly above, sometimes slightly below. During the same period, the Bitcoin network's hashrate grew by about 35 per cent. Compared to summer 2022, the hashrate even doubled. The hashrate is a measure of the total computing power that Bitcoin miners deploy to secure the network.It is striking that the computing power has risen so fast, while the exchange rate has remained more or less the same. This is because, in principle, computing power follows the exchange rate. A higher exchange rate creates higher revenue for miners, allowing them to spend more on computing power. The explanation for this has many ingredients. We would like to mention two here.

First, numerous miners have invested heavily in new sites and new equipment. Increasingly, they do so in partnership with energy producers, grid operators, and governments. By April 2024, the reward per block will halve, and yet they think they will still be profitable after that time. They expect the price of bitcoin to rise in the future.

Now we are increasingly seeing more complex revenue models that take advantage of the unique nature of bitcoin mining, namely that the operation is easy to move around and can scale up and down infinitely within seconds.

For instance, mining helps make grid electrification profitable by temporarily buying power while the infrastructure is still being built. Or by quickly responding to changes in energy demand on demand. Or by capturing methane and preventing it from entering the atmosphere. These functions provide additional revenue or lower costs.

So is the optimism among miners beneficial for the price? There is no direct mechanism by which higher computing power causes higher prices. But indirectly, that may be the effect.

As the hashrate increases, it becomes more difficult for saboteurs to attack the bitcoin network. An attacker with more than half of the computing power under his control may try to censor or reverse transactions.

More computing power means more security for the users of bitcoin as an independent, global infrastructure. These are the people who use bitcoin as freedom money who want to prevent their dictator from censoring payments. But also investors who want to be sure no one can counterfeit their digital gold. And so a growing hashrate and a healthy mining sector makes bitcoin more valuable after all.

There are models you can use to say something about the value of a network. For instance, Metcalfe's law has been used to determine the value of telecom networks since the 1980s. It states that the value of such a network grows with the square of the size of the network. As a measure of size, for example, one takes the number of users.

Later, this law was also used for other networks where network effects play an important role, such as social media. For instance, it proved to describe the stock market value of Facebook and Tencent quite nicely. But it also fits Apple's ecosystem with users, service providers and app builders. And Tesla's network with car owners and charging stations.

A thriving mining sector reinforces bitcoin's network effect and, via increasing adoption, ultimately affects its price. But that is a long-term effect. In the short term, external forces are stronger, such as macroeconomic conditions and collapsing crypto companies.

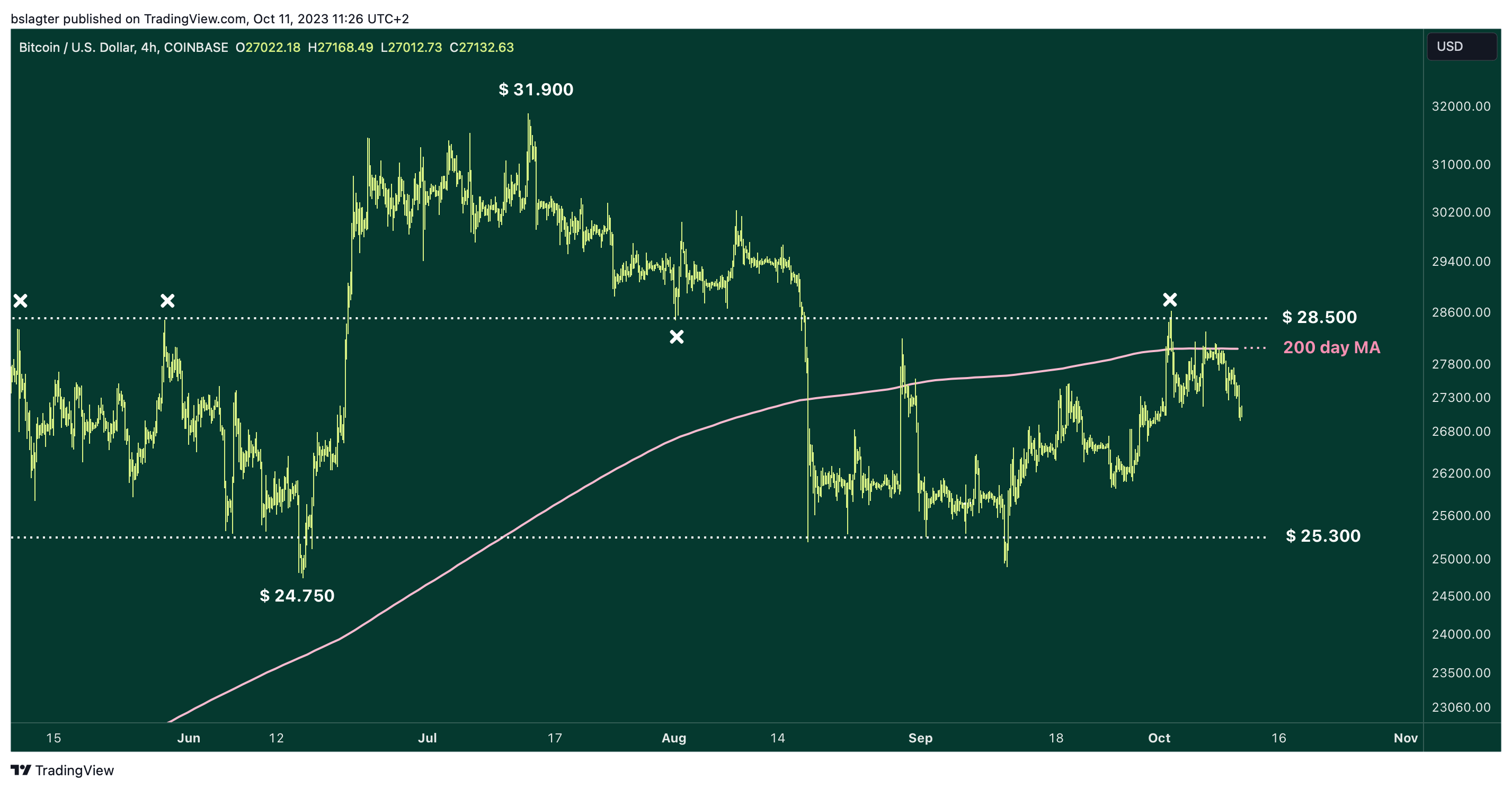

Below is the chart of the bitcoin price over the past five months. The price is now below the 200-day average, a dividing line between a medium-term upward and downward trend.

In the short term, the $28,500 horizontal level is likely to play a more important role.That level has been support and resistance on a number of occasions.Bitcoin remained surprisingly strong in macroeconomically challenging conditions, with a more expensive dollar and rising interest rates.Still, for more optimism, we want to see a breakout above $28,500 first.

News summary

We start the news summary with a brief report on the criminal case between the US government and Sam Bankman-Fried, the former top executive of FTX. Last week, Bankman-Fried saw old friends on the witness stand. Piece by piece they blamed him. 'We committed fraud, at Sam's behest,' was the common thread.

The most notable witness appeared for the first time on Tuesday. Former Alameda CEO Caroline Ellison said the trading house misused a total of $14 billion in FTX customers' assets. That money was used for investments and political donations. Ellison said she followed Bankman-Fried's instructions and also reported to him. She also told about personal loans Alameda issued to FTX's top executives. By 2022, the amount lent amounted to $5 billion. Ellison's testimony took a striking turn when she opened up about Bankman-Fried's ambitions; who, according to her, wanted to become US president.

We are closely following the trial, which continues this week.

On to renewed enthusiasm for innovation around bitcoin. A new paper was published this week by cryptographer and developer Robin Linus. He introduced BitVM, a thinking framework in which running arbitrary computer programmes on bitcoin is possible. Linus argues that with the current scripting language, bitcoin can support smart contracts that are highly expressive, similar to the application capabilities offered by Ethereum.

Linus' idea has a lot of support. Remarkably, this support comes from all ranks. Developers are getting to work on it, including looking for solutions to the limitations found. "BitVM is a tremendous breakthrough, and although there are still large gaps in it at the moment, they are largely solvable," say the tech giants. It has been a while since a bitcoin paper stirred such a large group.

The elaboration of Linus' concept is still at an early stage. It is therefore still unclear what concrete applications will emerge from it. But the genie is out of the bottle. "This new paradigm about using bitcoin is not going to go away," writes developer Bob Bodily on X.

Other news:

DNB sent excessive bills to crypto companies for years. That is what the court ruled in a case brought by the industry against the regulator. Since May 2020, Dutch crypto companies have had to register with DNB. The law prescribes a relatively simple procedure, but DNB chose to 'dress it up'. Thus, it became a disguised and heavier licensing regime. The costs arising from making the procedure more onerous were charged unlawfully.

Kraken underlines European expansion with the acquisition of Dutch broker BCM. BCM, formerly Bitcoin Meester, has been operating in the Netherlands since 2017. Kraken CEO David Ripley calls the Netherlands a "key market" for its exchange. The acquisition has not yet been finalised and is still awaiting approval from the Dutch regulator.

Former BlackRock executives call spot bitcoin ETF "a done deal". Both Steven Schoenfield and Martin Bednall believe the regulator will give the green light to the applicants within three to six months. The duo cite the disappearance of delaying tactics and Grayscale's win in court as key ingredients of their assessment. They expect stiff competition for BlackRock: "There are eight or nine other firms that are strongly committed to tradable digital assets," Schoenfield said.

Deepen

This week's Cryptocast is all about the Dutch crypto sector. Patrick van der Meijde announces that he is handing over his role as chairman of Verenigde Bitcoinbedrijven Nederland to Bert de Groot. With both men at the table, Herbert Blankesteijn discusses the court case between the sector and regulator DNB. They then look at the sector as a whole. Where do things stand? What are the consequences of the bear market? And what will supervision under MiCA look like?

PECB Insights Conference in Paris

Last week, Mauro Halve (Senior Compliance Officer at Amdax) spoke at the PECB Insights Conference in Paris. At this privacy conference, Mauro addressed the privacy and data protection risks of the proposed European Digital Identity in a panel discussion.

How Mauro plans to curb the risks? With Zero-Knowledge Proofs: a cryptographic method of encryption that allows you to prove a proposition digitally, without having to expose the evidence (private data, for example).

For example, you can prove that you live in a specific area without sharing your address, verify your age without revealing your date of birth, or prove that you earn enough for a mortgage application without revealing your salary. While maintaining privacy over your personal and sensitive data, this technology even allows you to meet all the requirements from a compliance perspective.

A successful conference, which Mauro may attend again next year as a speaker.

Our website uses cookies

We use cookies to personalize content and advertisements, to offer social media features and to analyze our website’s traffic. We’ll also share information about your usage with our partners for social media, advertising and analysis. These partners can combine this data with data you’ve already provided to them, or that they’ve collected based on your use of their services.