Bitcoin celebrates a quiet Christmas

27 December 2023

We are looking back at a quiet crypto week. There is no talk of an end-of-year rally (yet). And the most important news still trickling in? In it are details about spot bitcoin ETFs that will soon be greenlit. More on that in this Weekly!

This Weekly in brief:

- Market: We are looking back a fine 2023 for the crypto market. After the recovery, bitcoin is only 36% below its all-time high.

- News: The moment of approval of US spot bitcoin ETFs is approaching. To be among the first wave of approvals, applicants must update their applications by 29 December.

- Behind the scenes: At Amdax, we look back on a year in which we continued to build new products, initiated exciting ventures, and, as the cherry on top, became the first cryptocurrency service provider in the EU to undergo an ISAE 3000 type 1 audit.

Cryptomarket

With four days to go, 2023 is coming to a close. In many ways, it was a great year for the crypto market. The crooks of the bear market ended up behind bars, and many countries introduced a good first step of regulation and oversight to reduce the chances of companies making a mess again.

Industry frontrunners are taking extra steps to demonstrate that all customers can withdraw their money and cryptos under any circumstance. There has been a lot of construction this year. Every bull market reveals new bottlenecks in technology.

The massive influx of new investors and users is the best stress test imaginable. In the following years, tens of thousands of programmers, designers, hackers, entrepreneurs, econometricians and lawyers are building the next generation of technology and a new wave of applications.

Adoption by the masses requires applications that are more useful, convenient, fun, cheaper and faster than the alternatives at hand. Eventually, the majority of people will use crypto infrastructure without realising they are doing so. A bit like you are also not consciously using the internet when you launch Whatsapp, Netflix or Spotify.

One of the first applications to be considered is stablecoin. It is now being rapidly adopted by consumers and businesses in emerging economies. They are saving, paying and sending money home from abroad with digital dollars captured on crypto networks.

At the very opposite end of the spectrum, you will find large financial institutions experimenting with tokenisation of financial instruments such as stocks and bonds. They too need stablecoins. Crypton networks provide a global independent infrastructure on which you immediately and irrevocably settle every transaction. You trade a digital share for digital money, as it were - right across. That digital money? Stablecoins.

And so, slowly and cautiously, we see one of the storylines of the next bull market emerging. Each bull market is the enabler of the next bear market, and from that bear market, the next bull market is then born.

Around the bottom of the bear market in November and December 2022, prices were excessively low. Fear and panic pushed prices below the value appropriate to actual usage and the magnitude of the network effect.

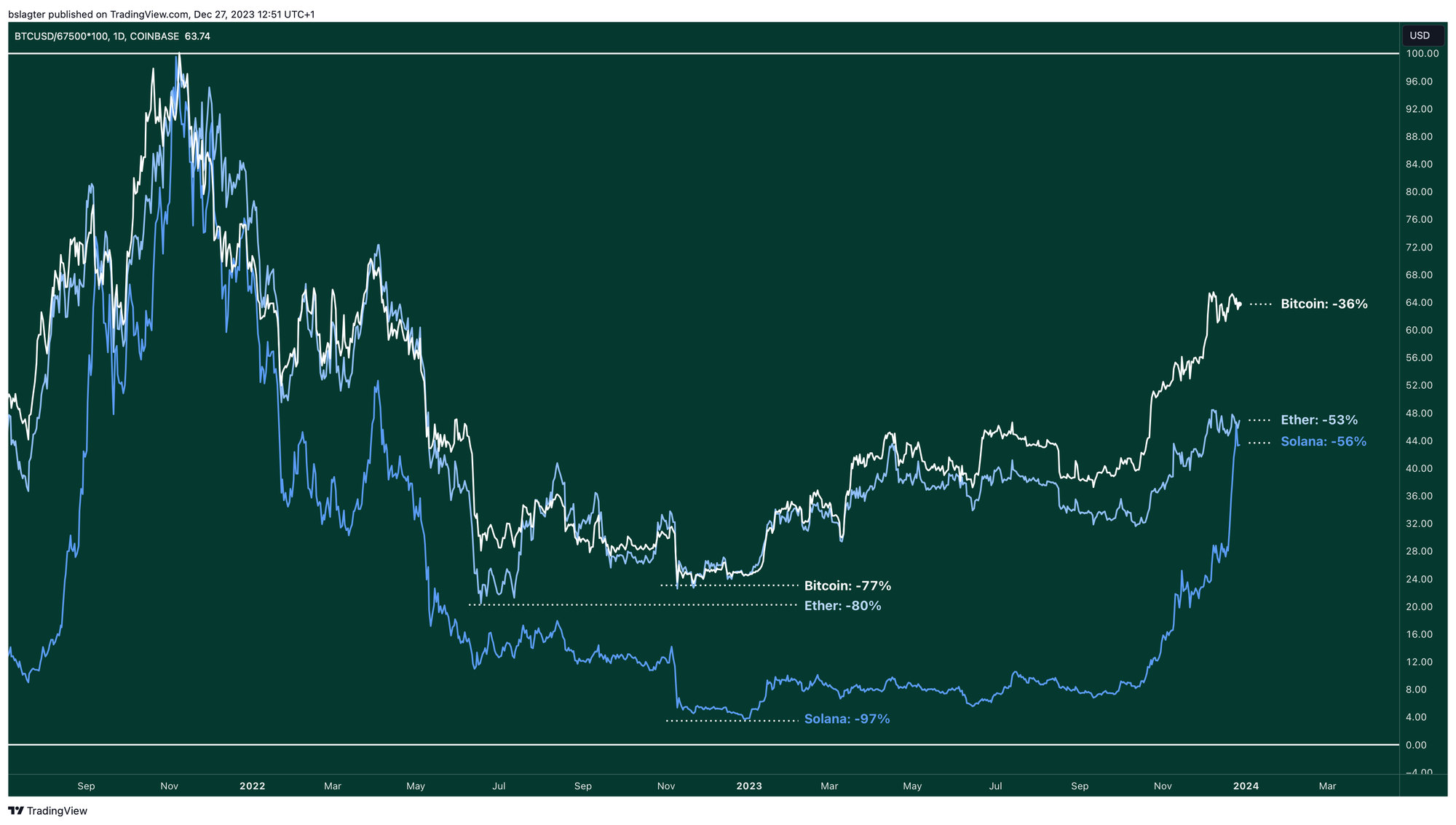

The year 2023 brought recovery. Coins that managed to convince investors of their existence and own network effect made up for more of their losses. Of the major coins, bitcoin tops the list with a price only 36% below its all-time high. Ethereum also performed remarkably well through the bear market and still stands at -53%.

With a few exceptions, the rest did worse. Even solana is still below ether after its remarkable rally in recent months at -56%. Cardano, ripple and polka dot are still around -80%.

If the current market cycle resembles previous cycles, it will be well into 2024 before new all-time highs are flying around our ears. All-time highs of the price in dollars, that is. Because there are many more figures to keep an eye on.

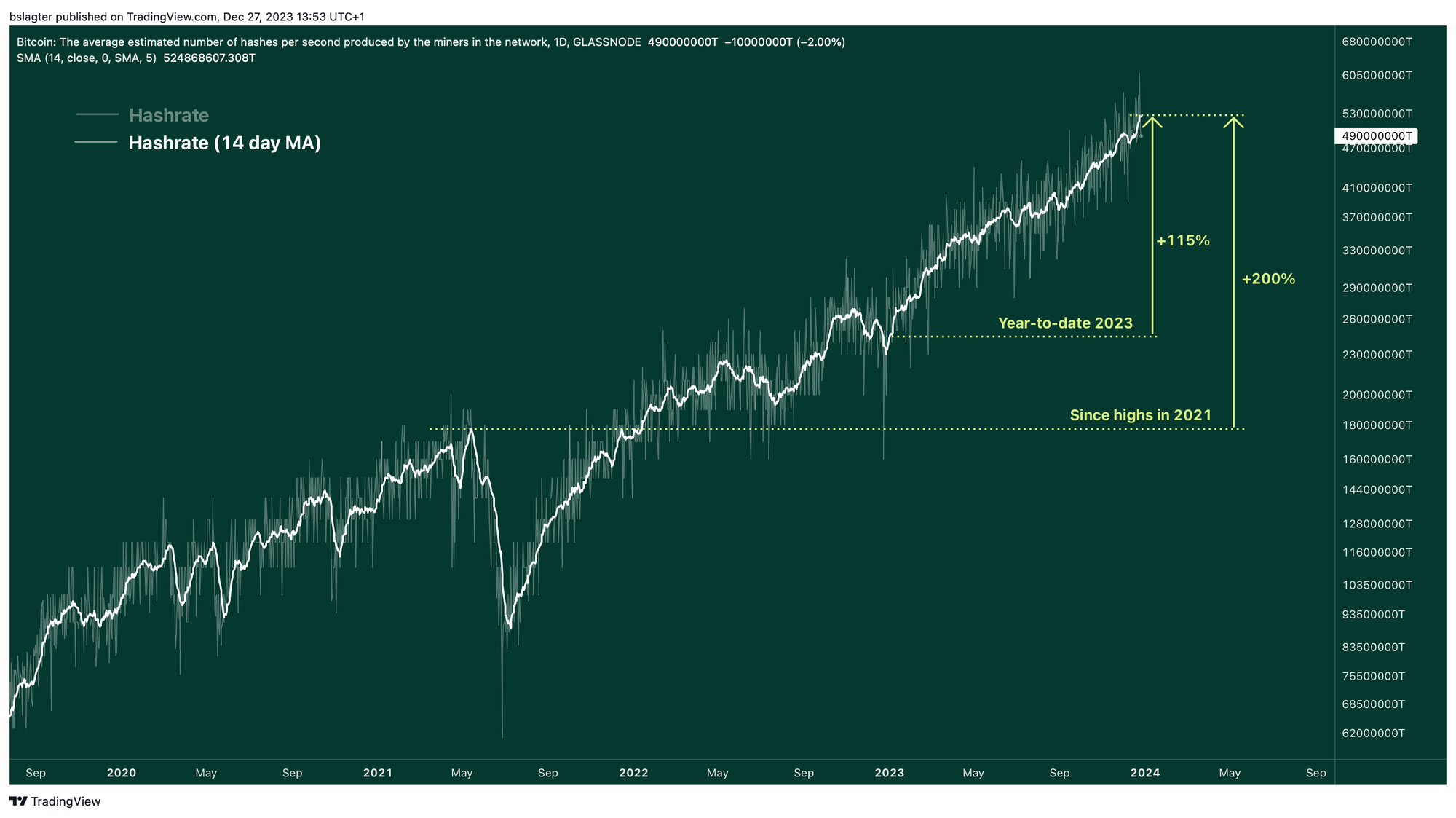

For instance, the computing power of the bitcoin network made record after record this year and is now well above the level of the previous bull market, see the chart below. Also, the number of bitcoin addresses with more than $1000 worth of bitcoin is well above its 2021 peak at almost 9 million.

These are indicators ahead of the price. Other figures are actually slightly behind, such as trading volume on exchanges and the total amount of stablecoins. But even these have clearly bottomed out by now.

Looking at it all, we seem to be closing 2023 in the middle of the spring of the market cycle. The cold winter of the bear market is now well and truly behind us, but it is also not yet a hot summer with large groups of new investors flooding into the market. If no major shocks occur then a nice 2024 lies ahead!

Want more market information?

We would like to draw your attention to an end-of-year promotion from our partner Bitcoin Alpha. You will receive a monthly subscription worth 25 euros as a gift. The subscription ends automatically, you just need to leave your e-mail address, AND you get a chance to win great prizes!

🎁 Claim your gift here!

News summary

During the holidays, news presses and editors are in well-deserved holiday mode. What still comes out mostly concerns a retrospective of the past year. Crypto companies seize that custom to publish voluminous reflections and predictions.

One of the common threads in all those reports is the US search for rules that suit crypto assets. The outcome of the 2024 presidential election could have a big impact on that. To make those as favourable as possible, big crypto companies like Coinbase and Kraken have together put $78 million in the purse of lobbying organisation Fairshake.

Another common theme is DePIN, or Decentralised Physical Infrastructure Networks. DePIN stands for decentralised networks that connect physical devices. To make these work, crypto assets are used to reward desired behaviour. One example is Helium, which launched a new decentralised internet in 2019. Globally, individuals manage access points to the network, which now consists of more than 370,000 so-called hotspots.

Other common themes revolve around gaming, the further development of blockchains, new DeFi applications, and the fusion of AI with crypto. But what really stands out with a bullet in every report? Spot bitcoin ETFs getting the green light in January.

So is it already certain? No, but in the meantime, analysts are talking about a 99.99% chance of getting there. The regulator has issued clear instructions, telling all applicants to update their applications by 29 December. "Fail to do that? Then you won't be in the first wave of approvals," writes FOX journalist Eleanor Terrett.

Like 2023, 2024 promises to be an eventful crypto year, but thankfully of a very different nature. Bloomberg analyst Eric Balchunas thinks ETFs could cause a "landslide" in the market. And Steven Larsen, financial planner at Columbia Advisory Partners, sees bitcoin reaching new markets, including American's retirement pot. "These ETFs will be available everywhere," Larsen said in conversation with CNBC. "This is great for people who want exposure to bitcoin."

Amdax sets a new standard

We have become the first cryptocurrency service provider in the EU to successfully pass a prestigious ISAE-3000 (type-1) audit. The purpose of the audit is to demonstrate that Amdax says what it does and does what it says. We consider it of utmost importance that our customers know that their crypto assets and euros are safe and will remain so in Amdax's vault, and they can withdraw them at any time.

Other news:

- Nigeria's central bank ends ban on banking services for crypto companies. Trading of crypto assets is also allowed again. The central bank says it is in line with the global trend of allowing and regulating these activities. The ban had been in place since February 2021. Banks and other financial institutions themselves are still not allowed to do anything with crypto assets.

- Blockchain games welcome again in Epic Games' Store. These include games that feature NFTs or other Web3 elements. "This policy change proves that the industry recognises the Web3 experience and that we are one step closer to adoption," writes game developer Immutable. GameFi is a frequent theme in the 2024 outlook.

- Argentina gives green light for contracts listed in bitcoin. The recommendation was made public by Argentina's foreign minister, Diana Mondino. She posted the message a day after Argentina's recently elected cabinet, led by President Javier Milei, announced a series of measures to get the economy out of the doldrums. It is unclear whether there is a broader plan to legitimise bitcoin in Argentina.

Deepen

Een Nieuwe Koers | Deepdive

In this episode of Deepdive, Marcel, Tim, Christophe and Ries again discuss what stood out recently. One of the most striking things was the huge rise in Solana's share price. What forces are behind this rise and what role do memecoins play in this kind of rise?

Behind the scenes

For the crypto market, the past year was all about recovery and building further. Confidence returned and crypto turned out not to be dead after all. At Amdax, too, we continued to build. We developed new services and improved our products. We helped other organisations build on our infrastructure, and shared our knowledge at events and in our own podcast.

As icing on the cake, we were the first crypto service provider in the EU to pass the prestigious ISAE-3000 Type-1 audit. An intensive project on which a large team within Amdax worked hard for months. We are immensely proud to reaffirm that Amdax is here for the serious crypto investor.

We wish everyone a happy New Year and a prosperous and healthy 2024.

Our website uses cookies

We use cookies to personalize content and advertisements, to offer social media features and to analyze our website’s traffic. We’ll also share information about your usage with our partners for social media, advertising and analysis. These partners can combine this data with data you’ve already provided to them, or that they’ve collected based on your use of their services.