Record number of bitcoin held by long-term investors

5 September 2023

Summer vacation is in full swing. Many people are enjoying some well-deserved rest. We see that calmness reflected in the crypto markets. In what ways? You can read that, and more, in this Weekly!

This Weekly in brief

Crypto Market: The crypto markets are quiet. The price is down slightly from last week. There is no question of overheating, according to several indicators you are now paying a fair price.

News: The calmness in the market is reflected in the behavior of bitcoin investors. Last month, the number of bitcoin held by long-term investors rose to a new record. This suggests that long-term holding is now the preferred strategy.

Behind the scenes: At Amdax, we continue to develop our products and services. The vault has received an upgrade. You can now click through to assets stored within it. This will show you a convenient and beautifully organized overview screen!

Crypto market

It's vacation time. Not only are many investors and traders away from their computers for a few weeks, but there's also a lack of definitive news. No technological breakthroughs, judicial pronouncements, or new entering institutional players for now.

The price of bitcoin has been gently meandering most days. Only last Monday, we observed a slight dip from around $30,000 to around $29,000. Since then, it's been moving sideways.

If you overlook a few outliers, the price has been fluctuating between $25,300 and $32,500 since mid-March, the price range we found ourselves in after the Luna crash. That's a solid four months. Given that we're nearing the end of July, we've marked this month in the chart below with a square.

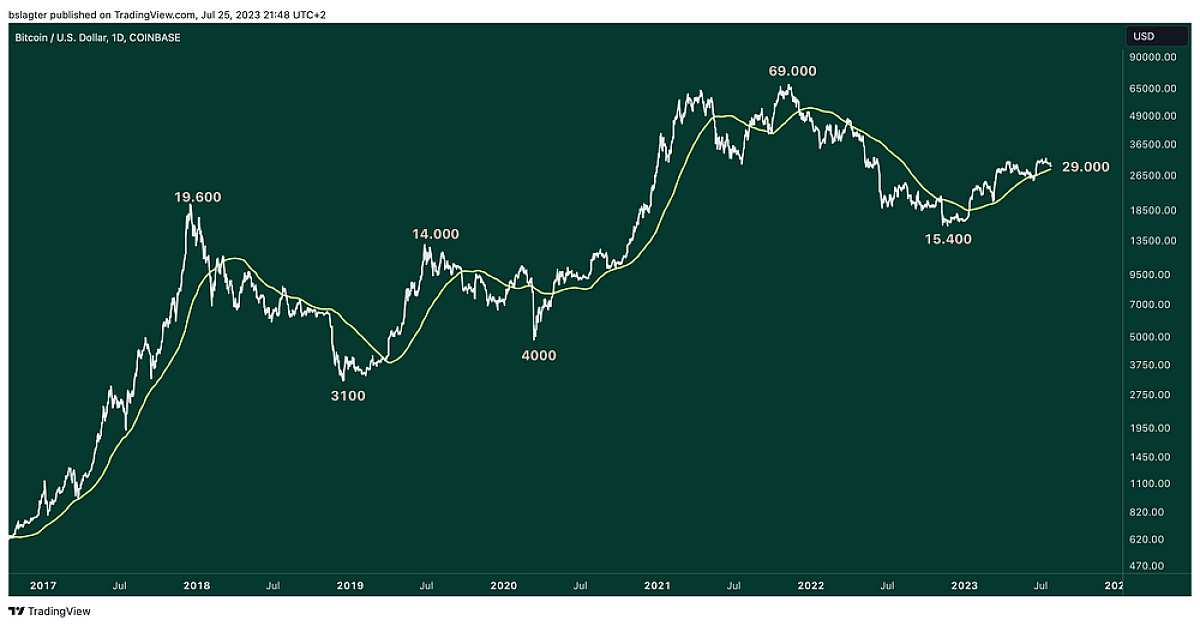

Now's a good time to zoom out a bit. Below is a chart of bitcoin's price over the past 7 years. The green line represents the 20-week moving average, which provides a good idea of the current trend: upward or downward.

During an upward trend, the price mostly stays above this line. And during a downward trend, it generally stays below this line. Currently, this moving average sits at $28,150. You can see on the right side that the price is slightly above it now.

There are more indicators like this that we use to determine whether the price is a bit high or whether you're getting a good deal at the current prices. One example is the realized price of short-term holders: the average purchase price of short-term investors. It's currently at $28,200.

If the upward trend continues, then the current price is fair. No overheating or hype. It's a great time to expand your position a bit. We also observe this happening in bitcoin transaction data. Short-term investors are taking some profits, and the buyers are long-term investors looking to grow their holdings.

News

In the realm of news, it's clearly the slow season. The calm has fully returned after last week's Ripple verdict. What's still making its way through the news mill, we mostly classify as noise. This applies to the vacation state of 'Crypto Twitter' as well, where some are using their free time to argue about nearly forgotten topics. You know what time it is when Plan B's Stock-to-Flow model is brought out once again. The debunking of it by Amdax asset manager Tim Stolte, published last year, has by now become a frequently cited source.

The tranquility in the market is reflected in the behavior of bitcoin investors. According to analysis firm Glassnode, the so-called Long-Term Holder Supply reached a new record this week. This refers to the portion of all Bitcoin that remains at the same address for an extended period.

Glassnode categorizes user cohorts using concepts like Long-Term Holders and Short-Term Holders. The company derives these classifications from observed statistical patterns and spending behaviors in bitcoin's blockchain. Together, they embody the characteristics of investors with low and high time preferences.

Long-Term Holders possess their bitcoin for periods ranging from several months to years. Short-Term Holders consist of newcomers in the market, active traders, and nervous investors who tend to exit their positions when the bitcoin price makes significant moves. According to Glassnode, the turning point is around 155 days; after that, it becomes increasingly unlikely for holders to spend their bitcoin in the short term.

Over the past month, the portion held by Long-Term Holders increased by 62,882 BTC, surpassing 14.5 million BTC, roughly 75 percent of the total bitcoin currently in circulation. According to Glassnode, this suggests that the preferred strategy among investors is to hold purchased bitcoin for the long term.

Other news

- Crypto division of Societe Generale gets license from French regulator.. In France, companies can be certified at different levels. The bank is the first company to receive approval at the highest level. At present, the company focuses primarily on institutional investors.

- Indonesia launches national crypto exchange. The government announced its construction in early 2021. After a series of delays, trading on the exchange started last week. Its setup is similar to the way traditional trading platforms are set up. The new exchange is the only place in Indonesia where crypto assets can be legally traded.

- Japanese prime minister calls Web3 transformative. He spoke on the subject at the Asian conference WebX. According to Fumio Kishida, Web3 technologies have the potential to fundamentally change the Internet as we know it. "Web3 is part of a new form of capitalism," Kishida said. He hopes to bring part of that Web3 economy to Japan with favorable laws and regulations.

Deepen

Unlike in other EU countries, the discussion about the digital euro has gained momentum in the Netherlands. In May, Inge van Dijk, DNB's division director, spoke about this topic on the Cryptocast.. And this week, Menno Broos was a guest on Holland Gold. Menno is the project leader for the digital euro at DNB and openly discusses the current situation regarding the digital euro. What role will it play in the European payment system? What advantages does Menno see in the digital euro? And how should we address concerns about ensuring privacy and its potential programmability?

Behind the scenes

At Amdax, we continue to develop our products and services. This also applies to the My Amdax environment. Starting this week, you'll find price charts of the cryptocurrency assets in your portfolio there. Additionally, this overview screen displays any open orders and the amount you have staked. A great update!

You can access this overview by logging in to my.amdax.com and then clicking on one of the assets in your vault.

Our website uses cookies

We use cookies to personalize content and advertisements, to offer social media features and to analyze our website’s traffic. We’ll also share information about your usage with our partners for social media, advertising and analysis. These partners can combine this data with data you’ve already provided to them, or that they’ve collected based on your use of their services.