Has the upward trend resumed?

31 January 2024

Last week, the correction in the cryptocurrency market continued. The price of bitcoin dropped to a low of $38,400 on Tuesday. Meanwhile, the price has rebounded by over 11%, now sitting above $43,000. Does that mean the correction is behind us? All this and more will be discussed in this Weekly update!

This Weekly in brief:

- Market: The price of bitcoin rebounded from a local low of $38,500 to $42,500 over the past week. This level has been the focal point of trading since early December and also marked the opening price of 2024.

- News: The Bitcoin network is becoming increasingly sustainable, with the share of sustainable energy reaching a record high of 54.5%. This surpasses any other industry operating on a global scale.

- Behind the scenes: We are proud to announce that Callisto Capital has selected Amdax's infrastructure. Callisto Capital is a Dutch open-end crypto fund that invests based on its proprietary algorithmic strategies.

Market Update

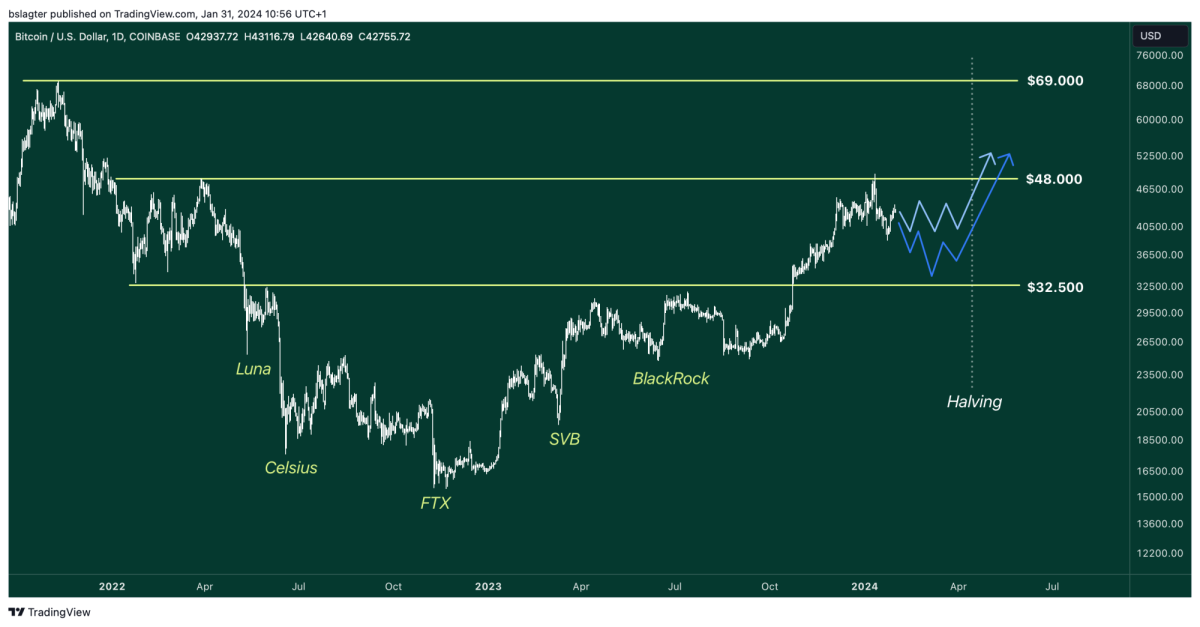

On Tuesday, January 23rd, bitcoin hit its lowest price in two months at $38,500. This bottom was 21% lower than the peak of $49,000 on January 11th, the day of the launch of the bitcoin ETFs. However, it's worth noting that this low was still 45% higher than where we started in October, beginning a thirteen-week-long rally that nearly doubled the price.

After hitting the recent low last week, the price has rebounded to around $42,500, which has been the primary trading range since early December and also represents the opening price of 2024. This situation can be seen as a crossroads. Will the correction continue from here, or is this the end, are we on the verge of a new upward trend?

The argument for an imminent rise lies in the fact that selling pressure from the outflow of Grayscales' ETF is decreasing while buying pressure from inflows into other ETFs remains steady. To balance this difference, ETF providers must purchase a substantial amount of bitcoins daily.

However, the evidence for this is still somewhat thin. Only in the last two trading days have we seen the inflow into the nine new spot ETFs significantly outweigh the outflow from GBTC. On Monday, the net inflow was 5,916 bitcoins, and on Tuesday, it was 5,690 bitcoins. In dollar terms, this amounts to over $500 million.

On the other hand, we don't know the source of this inflow. Industry experts suspect that a significant portion of it comes from individuals switching their holdings. These investors may have had self-managed bitcoins, shares in non-U.S. bitcoin ETFs, or futures positions, which they are liquidating and exchanging for shares in one of the spot ETFs.

This aligns with the assessment of ETF experts, who suggest that it takes months for new retail investors to start buying bitcoins through their financial advisors, not to mention institutional players, who would likely need at least half a year to make a small allocation.

Therefore, it seems more likely that we will see further correction in the cryptocurrency market in the coming weeks. In the best-case scenario, this could be a sideways correction, with the price remaining within the current range for several weeks. The baseline scenario is that we will find a bottom later in February, possibly below $38,500, marking the starting point for a new weekly cycle of around five months, often characterized by a strong start. This could potentially bring us close to the all-time highs of 2021, with prices above $60,000. For more on the timing of the bitcoin market cycle, read the Alpha Markets report.

The rest of the cryptocurrency market is closely following bitcoin's lead. Most altcoins are experiencing slightly larger losses than bitcoin, although there are always exceptions. This week, Solana, Avalanche, Celestia, and TAO performed exceptionally well. However, even these outliers are likely to face headwinds if bitcoin indeed undergoes further correction.

News summary

Over five years ago, bitcoin gained a reputation as a climate problem, seen as a technology with a significant role in global warming, posing a threat to climate goals and causing major disasters. In the prestigious scientific journal Nature, an opinion piece titled "Bitcoin emissions alone could push global warming above 2°C" was published in 2018.

This narrative continued to circulate, even though the publication in Nature was heavily criticized. Fellow scientists labeled the research as "fundamentally incorrect" and advised that it "should not be taken seriously by researchers, policymakers, or the public."

Climate activist and bitcoin enthusiast Daniel Batten was deeply bothered by this misinformation. He embarked on a mission to set the record straight regarding Bitcoin's energy consumption. Batten aimed to base Bitcoin's image on reality rather than incorrect and outdated assumptions, models, and data.

The result of his efforts has been remarkable. Slowly but surely, the perception of Bitcoin has shifted to the point that Batten spoke of "the big Bitcoin narrative shift." Here are a few examples of this transformation:

- The Independent: "Bitcoin mining can accelerate the transition to sustainable energy."

- FT: "Bitcoin can generate favorable ecological and social outcomes."

- The Hill: "How bitcoin mining promotes sustainability through green innovation."

- Bloomberg: "Bitcoin miners utilize Iceland's surplus sustainable energy."

- MIT: "How bitcoin mining saved an African national park."

This week, Batten announced that a total of 22 Bitcoin miners are preventing the release of methane gas. Together, these miners contribute 1.2% of the computing power of the Bitcoin network, yet they offset 7.3% of the network's total emissions. Batten writes, "There is no other sector that manages to directly mitigate such a large percentage of network emissions."

In recent years, the Bitcoin network has become increasingly sustainable. According to Batten, the share of sustainable energy in 2023 reached 54.5%, setting a new record and surpassing any other industry operating on a global scale.

Asset Management at Amdax

The smart investor entrusts the management of their cryptocurrency assets to the experts at Amdax. They are familiar with every corner of the domain and skillfully navigate the pitfalls. Let your wealth be managed by our experts, with personal attention and a well-balanced approach to risk and return.

Other news:

- Tesla steadfastly holds thousands of bitcoins on its balance sheet. The latest quarterly figures reveal that Elon Musk's company still possesses 9,720 BTC. Tesla is the third-largest corporate bitcoin holder. In February 2021, the company purchased $1.5 billion worth of bitcoin, and in June 2022, it sold three-quarters of that investment. Since then, the bitcoin world has been closely monitoring Tesla's balance.

- Venture capital is once again flowing into 'zero-knowledge' projects. zero-knowledge proofs

allow a statement to be proven without revealing the underlying evidence. They are seen as a promising building block for the next generation of second-layer technology. "We are now on the verge of transitioning from research to production with zk [zero-knowledge]," writes Axiom on X. The project raised $20 million in its Series A round this week.

- FTX strengthens its cash position to be able to repay customers. According to Bloomberg, it increased from $2.3 billion in October to $4.4 billion by the end of 2023. It is likely to have grown even further in January. FTX sold 22 million GBTC shares, totaling nearly $1 billion. Customer claims worth over $1 million were traded at about 73 cents per dollar on Friday. In October, the claim price was nearly 50% lower.

Deepen

BNR Cryptocast (Dutch)

BNR's Cryptocast this week aligns well with the news section of this Weekly. Danny Oosterveer, podcast host at De Groene Nerds and Een Nieuwe Koers of Amdax, is the guest. Danny explains that bitcoin mining is having an increasingly significant impact on the transition to sustainable energy. This is being recognized by more and more parties, including scientists and major media publications. What does sustainable mining look like? And in what way might bitcoin make the transition to 'carbon negative' in the future?

Deepdive | Een Nieuwe Koers (Dutch)

In this deep dive, the Amdax Asset Management team discusses the potential catalysts for a new bull market. One of them is the Bitcoin halving, expected to occur in April this year. How significant is the halving's impact on the price? And what does this mean for Bitcoin miners?

Behind the scenes

A secure, reliable, and scalable foundation. That's the principle upon which our infrastructure has been built. The objective?

To contribute to the maturation of the crypto sector, allowing professional entities like (crypto) funds to invest safely and confidently in crypto assets. With our institutional-grade infrastructure, we make this possible.

We are proud to announce that Callisto Capital has chosen Amdax's infrastructure for these reasons. Callisto Capital is a Dutch open-end crypto fund that invests based on its proprietary algorithmic strategies.

Explore the possibilities of our advanced infrastructure for funds and professional entities on our website.

Our website uses cookies

We use cookies to personalize content and advertisements, to offer social media features and to analyze our website’s traffic. We’ll also share information about your usage with our partners for social media, advertising and analysis. These partners can combine this data with data you’ve already provided to them, or that they’ve collected based on your use of their services.