Weekly: Bitcoin is a force for good

16 August 2023

'Bitcoin critics misinterpret its ESG impact,' reads the summary of a recent KPMG report on bitcoin. The authors explain why bitcoin fits good into an ESG-weighted portfolio. You can read that, and more, in this Weekly!

Cryptomarket

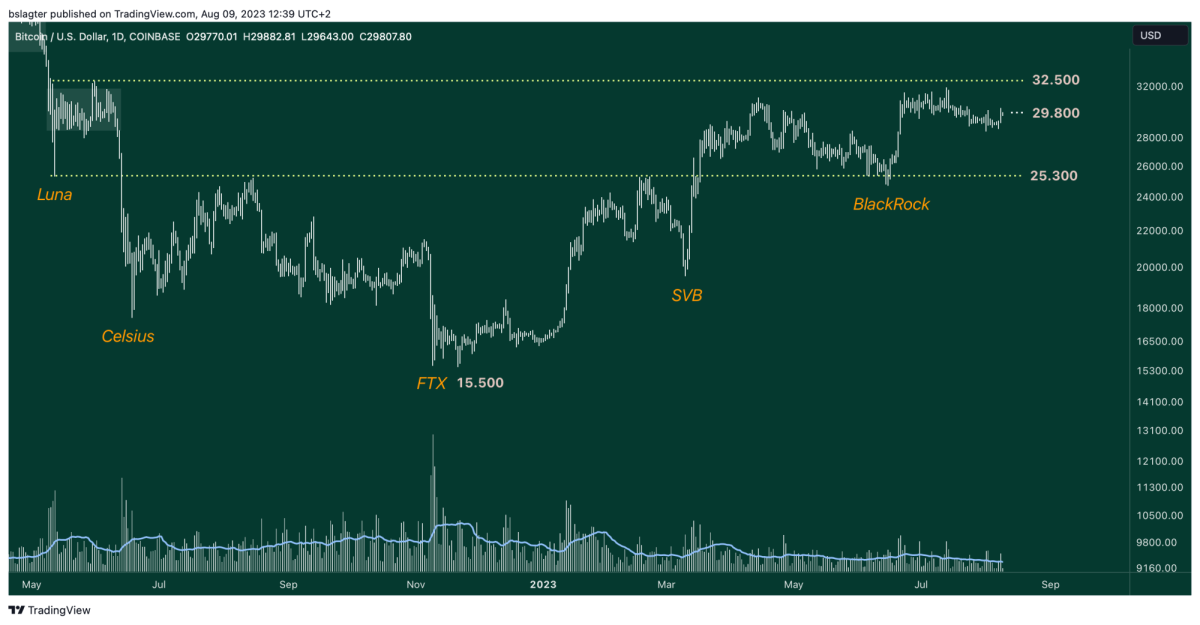

Over the past week, the bitcoin price has been between $28,700 and $30,200. On 15 June, BlackRock filed its ETF application with the regulator. After that, the bitcoin price rose almost 30% in a short time to its highest point this year at $31,800. Since then, the price has been going sideways.

The chart below shows that we are almost five months into the post-Luna crash price range, between $25,300 and $32,500. The trend is still positive, with higher bottoms and higher tops. But volatility and volume are low.

At the bottom of the chart, you can see the trading volume on Coinbase, the largest US trading platform. The blue line is the 20-day average of volume. That is now at its lowest point since autumn 2020, prior to the previous bull market.

Is this calm before the storm? On social media, you regularly hear the assertion that an explosive move always follows this kind of calm, and then, of course, upwards.

This is a meaningless prediction at best. Of course, there will be another period of higher volume and volatility at some point. And because the bitcoin price has risen sharply over the past 12 years, historically most of those volatile periods saw sharply rising prices.

But if you look closely, you will see that there are often longer periods of calm and long periods of turmoil. In other words, chances are that a quiet day will be followed by another quiet day.

So we will not be roused by predictions of an imminent price explosion. Instead, this is a period when investors can quietly build a position for the coming years.

In this, we see two main groups. The first group wants to own bitcoin for the next decade or more, as a permanent part of the portfolio. The second group is anticipating a new bull market in 2024 and 2025, looking at the rhythm of previous market cycles.

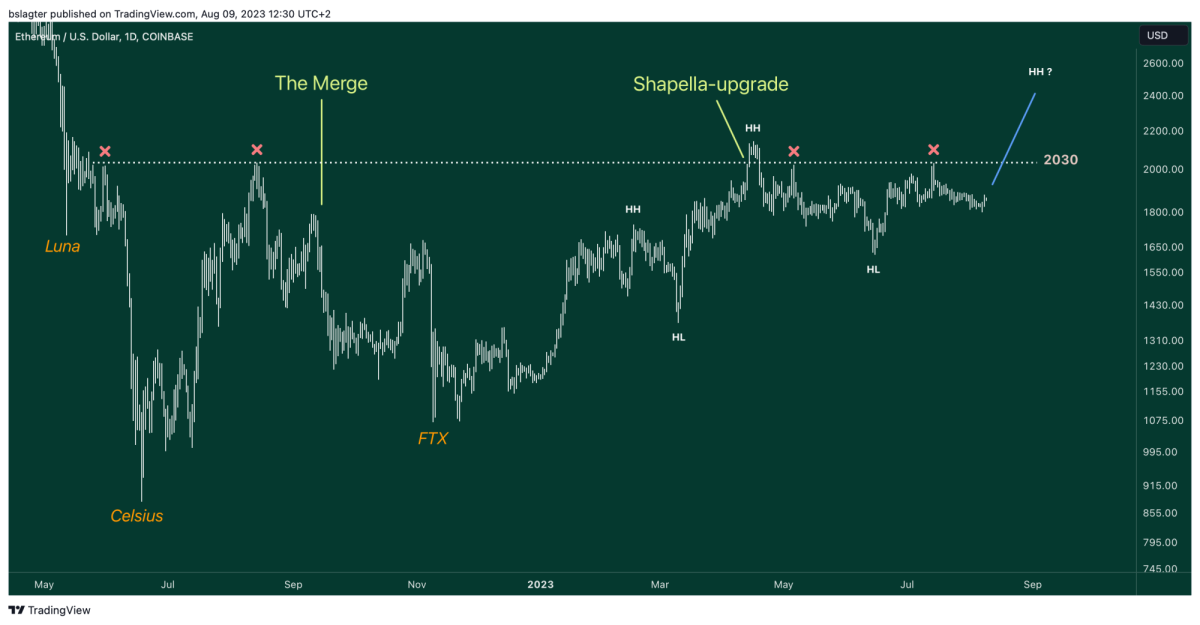

More and more investors are also looking at ether, the currency of the Ethereum network. It has acquired its own existence in recent years, with its own network effect and its own reasons why it can become successful (or fail).

The chart below shows ether's price over roughly the same period as bitcoin's chart above. We also see a rising trend there in recent months with higher lows (HL) and higher highs (HH). And also the same calm as bitcoin.

At ether, the $2030 price seems to be the line in the sand. Except for a single outlier, the advance there was stopped four times. For another higher high, the price will really have to rise above it. We will keep an eye on this in the coming months!

News summary

As a serious investor, you are undoubtedly familiar with the acronym ESG. This term summarises the three main factors of sustainability: Environment, Social and Governance. Those who value these as investors take into account factors such as carbon emissions, employee working conditions and the level of corruption in an organisation in their investment selection.

An ESG score, which expresses a company's sustainability performance, is the best fit for a company. Companies can define their policies, optimise processes on ESG factors, and report on them to the outside world. For a commodity, such as silver, gold or bitcoin, this is more difficult. But KPMG likes a challenge, and recently published an ESG report focusing on bitcoin. The short conclusion is that bitcoin makes a positive contribution to the sustainability score of an investor's portfolio. To this end, the consultancy cites the following factors.

Environment

- Bitcoin stimulates the use of renewable energy.

- Bitcoin increases the flexibility of power grids.

- Bitcoin greens heat-based applications.

- Bitcoin reduces methane emissions

Social

- Bitcoin unlocks low-cost cross-border payments.

- Bitcoin serves as a safety net for failing, traditional money systems.

- Bitcoin drives electrification of remote areas.

- Bitcoin encourages financial inclusion.

Governance

- Bitcoin removes the need for trust.

- Bitcoin neutralises power relations.

KPMG is sending an important message with this. Bitcoin is a force for good in several ways. It is time for investors to turn their perspective away from the unsubtle one-liners often seen in the media. The thoughtful content with which KPMG provides nuance is a great starting point for that!

Other news:

- Large number of applications for ether ETFs filed with the SEC. Fourteen applications have been filed in just a week. These are futures-based products. So far, the regulator has never approved them, while similar bitcoin products have been around since October 2021. If the SEC raises no barriers, the first funds will open in mid-October.

- MicroStrategy wants to buy $750,000,000 worth of bitcoin. A prospectus filed with the SEC shows that the company wants to issue new shares. The proceeds, up to 750 million, are intended to replenish its bitcoin coffers. In the second quarter, MicroStrategy bought 12,300 BTC. That brings the cash total to 152,800 BTC. If the full amount is raised, more than 25,000 BTC could be added.

- PayPal launches its own stablecoin PYUSD. Before launching the coin, the company initially wanted to partner with FTX and Solana. But due to the events surrounding the exchange, the launch was postponed. "We are now seeing regulatory progress towards more clarity," the company said in conversation with Bloomberg. PYUSD is anchored on Ethereum. At the time of writing, there is just under $27 million of PYUSD in circulation.

Deepen

Opinions are divided over the launch of PayPal's own stablecoin. For some, it is more of the same, while others call it the biggest event of the current crypto year. In The Breakdown, Nathaniel Whittemore takes on the latter group. In a short episode (14 minutes), he places the arrival of PYUSD in an important trend of this bear market.

Behind the scenes

At Amdax, we think it's important to guide you through the world of crypto and digital assets. Do you run into something when using our services? In our help centre, we provide answers to your questions through articles and videos. Among other things, we explain step by step how to send crypto assets and how to secure your account properly.

Can't find what you're looking for? Then we are at your service via chat, phone or email.

Our website uses cookies

We use cookies to personalize content and advertisements, to offer social media features and to analyze our website’s traffic. We’ll also share information about your usage with our partners for social media, advertising and analysis. These partners can combine this data with data you’ve already provided to them, or that they’ve collected based on your use of their services.