Bitcoin correction continues

1 May 2024

A week ago, the

cryptocurrency market geared up for the fourth halving. In the night from

Friday to Saturday, it finally happened, and now the fifth so-called reward era

is already four days old. How did the halving go? And what's on the agenda

next? That, and more, you'll read in this Weekly!

This Weekly in brief:

- Market: The correction in the crypto markets continues. The price of bitcoin closed the month above $60,000 but then began a steep decline. The flow of money into the American ETFs has come to a halt. Will this be the end of it, or will there be more?

- News: Authorities in the US are tightening the noose around the crypto sector. This is creating a stifling sentiment that makes companies and entrepreneurs hesitant to offer their services to Americans.

- Behind the scenes: In the first quarter of 2024, we surveyed sentiment among high net worth and experienced crypto investors together with Satoshi Radio. We share our findings in the Crypto Barometer.

Market update

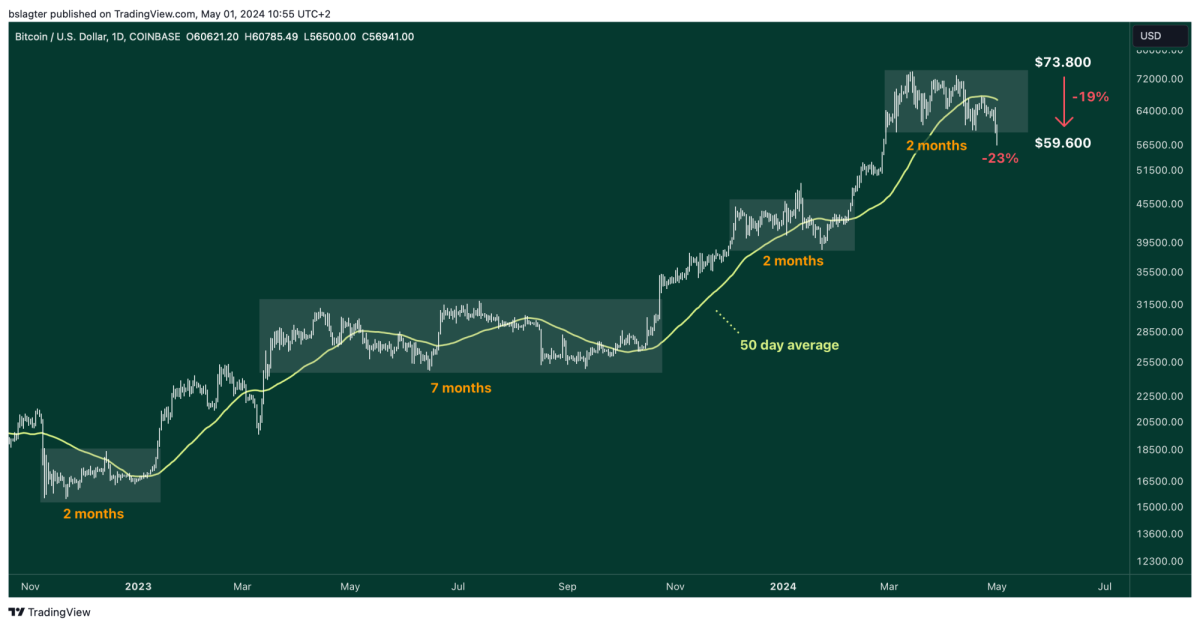

The price of bitcoin has been moving sideways for two months now, between $60,000 and $74,000. Measured from the top, this is a difference of 19%. This is comparable to the width of the price range in which the price was trapped in December and January. The price range in the summer of 2023 had the same magnitude when we spent more than seven months between roughly $25,000 and $32,000.

After a month-end closing above $60,000, the price began a steep decline on Wednesday morning. Is this a short-term outlier outside the price range, or will this be the first correction of this bull market with a depth of 30%? That wouldn't be a disaster. In previous bull markets, we frequently saw corrections of between 30% and 40%. This would establish a bottom for the price between $45,000 and $52,000.

What we like to see in a bull market is that the peaks and troughs are gradually rising. So far, that's the case. Only when this correction brings us below $38,500 will the series of higher lows be over. We're nowhere near that yet.

Most of the indicators we follow suggest that we are not at the end of this bull market yet. Therefore, we expect to resume the upward trend after this correction. There is a lot of uncertainty about the timing. There are arguments for recovery after a bottom in May, but also for a longer correction until after the summer.

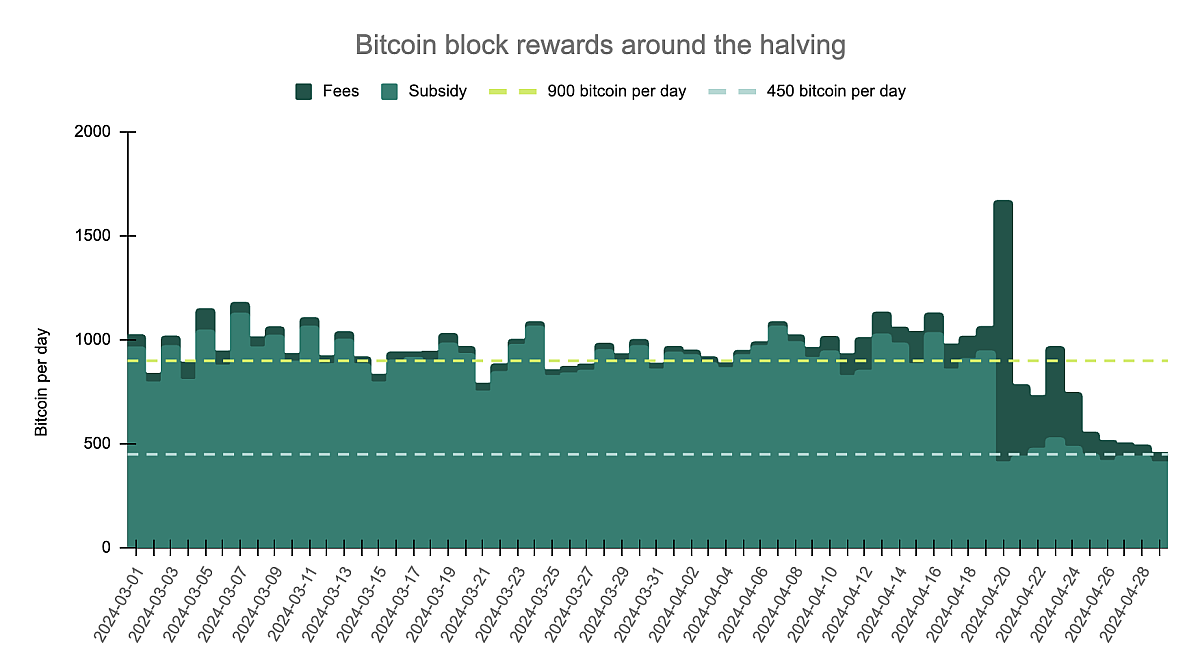

In last week's Weekly, we briefly looked back at the bitcoin halving that took place on April 20. With the halving, the Runes protocol was launched, which immediately led to increased activity and sky-high transaction fees. For miners, this was a nice bonus. Until Monday, these extra revenues more than made up for the halved subsidy.

The chart below shows the subsidy in the light shade and the fees in the dark shade. Together, they form the total revenue for the miners: block reward = block subsidy + fees. In March and April, the total reward was slightly above 900 BTC per day, exactly what we expected. A subsidy of 900 BTC and on top of that a tip of a few tens of bitcoins in fees.

Since the halving, the subsidy has halved to 450 BTC per day as expected. Added together, the fees have more or less compensated for the difference until Thursday, April 25. In total, 2659 BTC in fees were paid in six days, and the missed subsidy in that period was 2700 BTC. Meanwhile, the storm has subsided, and the fees have dropped to well below 450 BTC. From now on, miners will have to make do with less income!

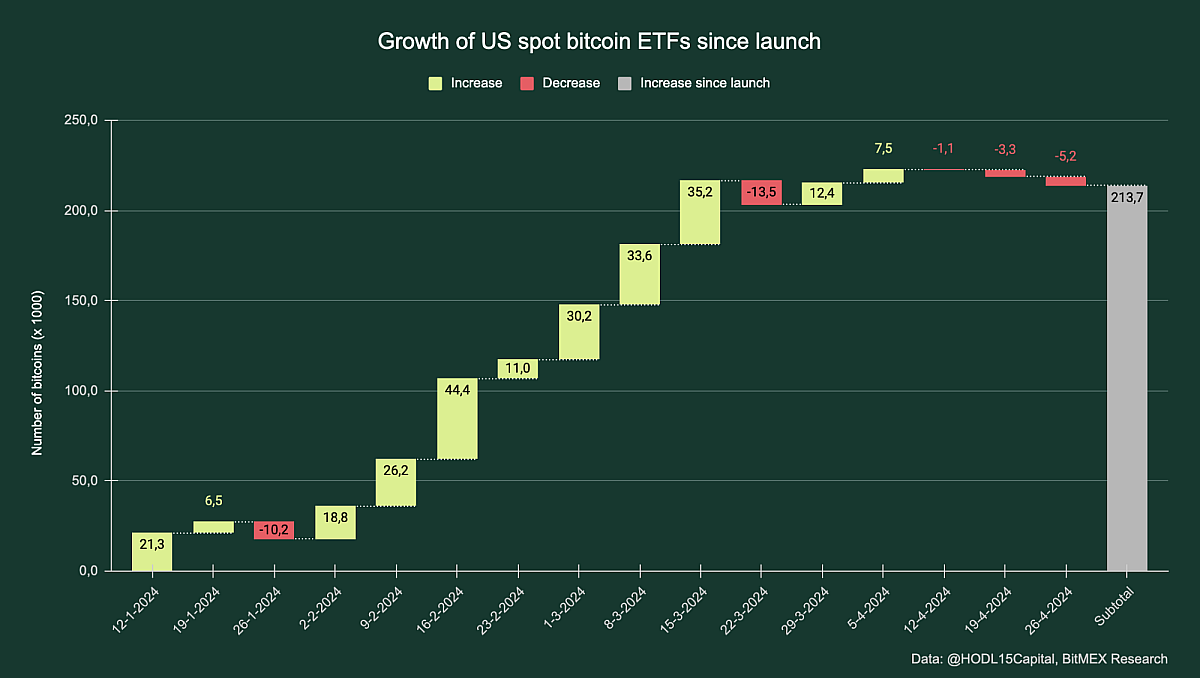

Finally, we take a brief look at the American spot bitcoin ETFs. In the first 75 trading days, over $12 billion in capital flowed into these new funds. By all standards, a great result, and probably the most successful ETF launch ever.

However, doubts and skepticism are becoming louder. Virtually all the results were achieved in the first 45 of the 75 trading days. Since mid-March, the balance has remained the same. Some slight inflow, some slight outflow — added up, we've barely moved forward for six weeks.

However, this is not a reason for pessimism. We already knew that the capital that flowed in during January, February, and March would only to a limited extent come from that new group of investors who now have access to bitcoin through the ETFs. Because a large part of them cannot (or may not) buy the ETFs yet.

Many intermediaries have not yet allowed the ETFs on their platforms. They are first waiting and seeing for a few months before doing so. This also applies to large institutional parties. They often may only buy ETFs after they have been traded for several months or quarters. For the long term, the inflow of recent months was noise, and the inflow of the next six months is the signal.

News overview

With every price movement comes a narrative that fits its direction. This time, the United States is attracting attention, where the offensive against the crypto market seems to have been renewed with vigor.

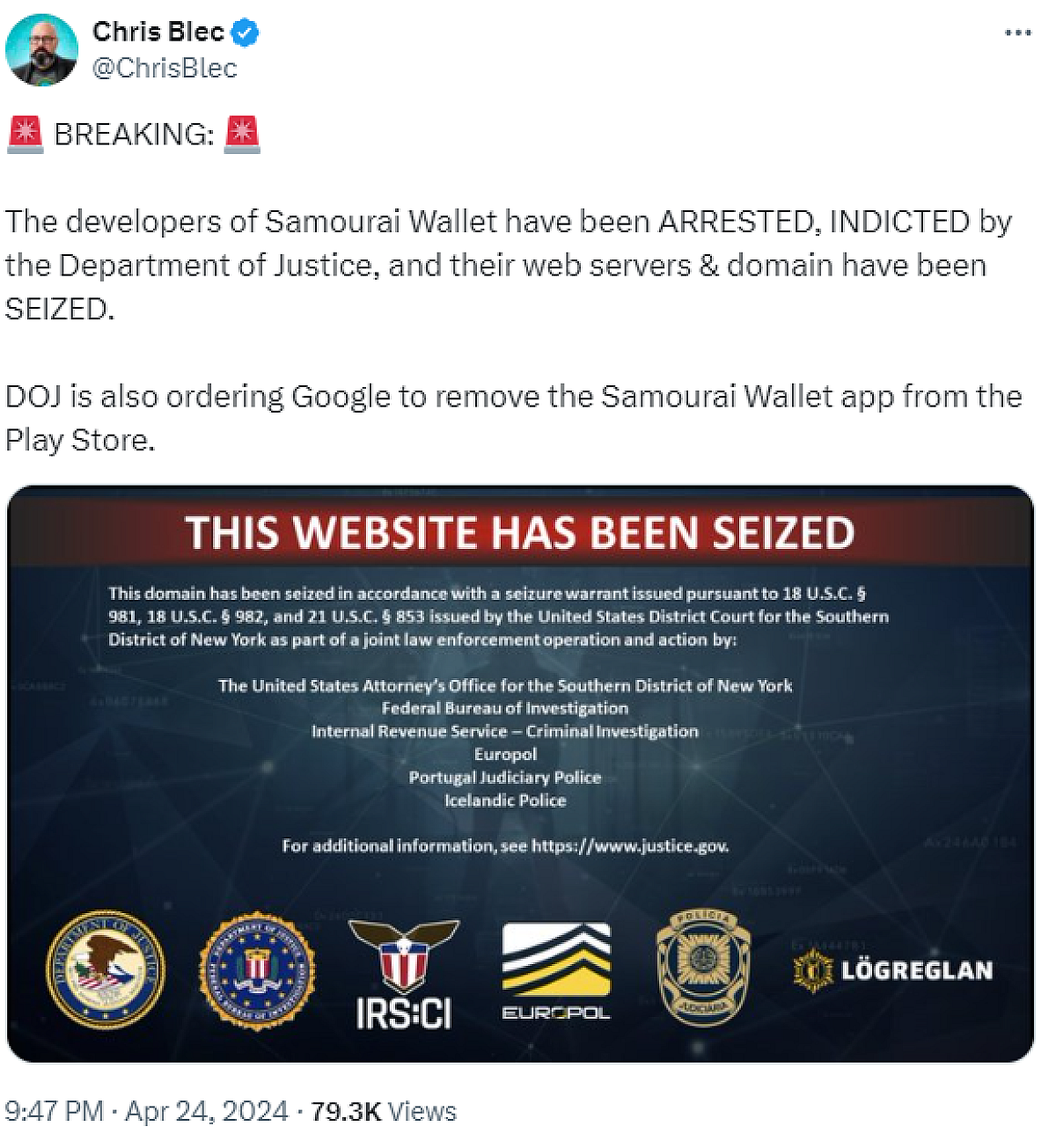

On Wednesday, the founders of Samourai Wallet were arrested. Just like with Tornado Cash, those involved are suspected of facilitating money laundering and terrorism financing. Indirectly, because it's not their own money. With the code they developed and published, money launderers could conceal their tracks.

In the US, crypto does not have an equivalent of The Protection of Lawful Commerce in Arms Act. This law was introduced in 2005 to grant immunity to producers and traders of firearms regarding anything their customers do with them. The law states that they cannot be "vicariously liable" for the decisions of others.

In the case of Samourai, the US Department of Justice alleges that both founders knew that a substantial portion of the money flowing through their software was of criminal origin. Indeed, according to the DOJ, that was the intention.

This is just one of the examples in which American entities active in the crypto world have come under fire in recent weeks. Regulators slowed down, law enforcement agencies issued warnings, politicians sounded the alarm, and judges were convicted.

The stifling sentiment in the US is causing companies and entrepreneurs to be cautious about offering their services to Americans. For example, Phoenix Wallet announced this week that it is removing itself from the American App Stores, a move to avoid facing justice. Other apps signal a more steadfast approach, but doubts are immediately raised. "Please don't let this age like milk."

Alex Gladstein, CSO of the Human Rights Foundation, responded on Twitter to the developments on Friday. The "reckless and unnecessary policy of the US" comes at the wrong time: "just when activists and democracy advocates need this technology."

Crypto Asset Management at Amdax

The smart investor entrusts the management of their cryptocurrency assets to the experts at Amdax. They are familiar with every corner of the domain and skillfully navigate the pitfalls. Let your wealth be managed by our experts, with personal attention and a well-balanced approach to risk and return.

Other news:

- Pantera Capital is seeking $1 billion for a new crypto fund. Pantera launched its first fund in 2013, over 10 years ago. Since 2013, the company has been investing in bitcoin. The capital of the new fund, Pantera V, is intended to be invested in startups and tokens. Pantera has provided financing to over 180 companies in total.

- Morgan Stanley is preparing to sell bitcoin funds. At least, that's what's circulating in the rumor mill. The bank already allows investments in the ETFs, but only if customers ask for them. The bank now wants affiliated brokers and intermediaries to pitch bitcoin ETFs directly to customers, according to the report.

- After six years, Stripe is reintroducing support for crypto payments. Initially, the payment giant only supported the stablecoin USDC. Supported blockchain networks are Solana, Ethereum, and Polygon. Stripe has a market value of $65 billion and processed over $1 trillion in payments last year.

Behind the scenes

Crypto Barometer 2024

In the first quarter of 2024, together with Satoshi Radio, we conducted research on sentiment among wealthy and experienced crypto investors: the Crypto Barometer 2024. Thanks in part to your input, last week we published our findings with some interesting expectations:

- Bitcoin price rises to $99,380 in 2024

- Ether outperforms bitcoin

- Solana becomes the most valuable crypto project after Bitcoin and Ethereum

- Celestia and Injective become the top newcomers

Always stay up to date?

Subscribe to the Amdax Weekly and receive a new Weekly in your mailbox every Wednesday.

Our website uses cookies

We use cookies to personalize content and advertisements, to offer social media features and to analyze our website’s traffic. We’ll also share information about your usage with our partners for social media, advertising and analysis. These partners can combine this data with data you’ve already provided to them, or that they’ve collected based on your use of their services.